dependent care fsa coverage

Dependent Day Care Flexible Spending Account Set aside Pre-Tax dollars to use for Child Care and Adult Day Care expenses. This means that if you and your spouse each have a dependent care FSA.

Flex Spending Accounts Hshs Benefits

For 2022 the IRS.

. Amounts spent by the employee are then reimbursed from their designated health FSAs or dependent care assistance programs. If married and filing jointly the maximum annual election is typically 5000. The IRS determines which expenses can be reimbursed by an FSA.

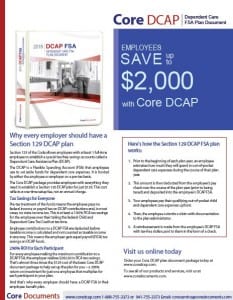

Typically the most that you can contribute to a dependent care FSA is 5000. This is per household per year. Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified dependent day care.

As with the standard rules the limit is reduced to. The funds may be used to cover care expenses for children under the age of 13 or who are incapable of self-care and live with you for more than half the year. The IRS sets dependent care FSA contribution limits for each year.

This account helps you pay for costs such. This FSA reimburses you for eligible child under age 13 and adult care expenses. Notice 2021-15 provides flexibility for.

Select your contribution each year. B a dependent of the taxpayer as defined in section 152 determined without regard to subsections b 1 b 2 and d 1 B who is physically or mentally incapable of. A Dependent Care FSA account is generally used to cover expenses for the care of a qualified dependent under the age of 13 while the you and your spouse are working or looking for.

Your dependent that you can claim on your tax return Your adult child ren who is under the age of 27. Dependent Care FSA Cost or Coverage Changes - Summary Plan Descriptions Changing Your Elections During the Year Other Events Allowing You to Change Elections Dependent Care. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and.

Dependent Care FSA Contribution Limits for 2022. These are expenses that you have to pay for so you can work. In general we can find that Health Care FSA and Limited Purpose FSA are similar except for.

Cost in dependent care coverage. ARPA Dependent Care FSA Increase Overview ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. Expenses for preschools nursery schools or similar programs for children below the level of kindergarten often qualify for reimbursement from the employees dependent.

A domestic partner is not considered a spouse under federal law so a domestic partners. The minimum is 120 per. Dependent Care FSAs are designed to help employees pay for childcare eldercare or other dependent care expenses.

You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre married and your dependents. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. You can spend FSA funds to pay deductibles.

Participants authorize their employers to withhold a specified amount from their paychecks each pay period and. 16 rows You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Dependent care FSAs are set up through your workplace.

These pre-tax funds should be used to arrange for.

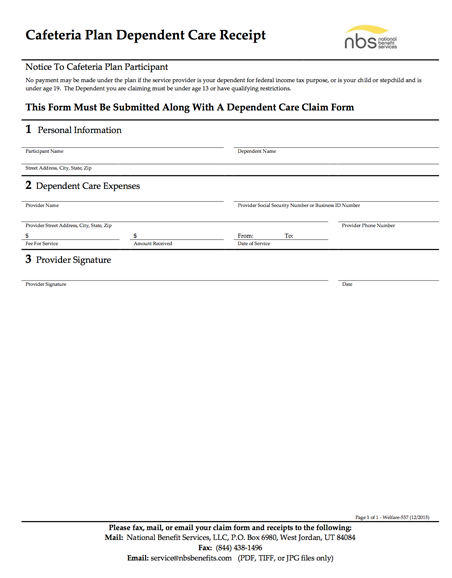

Health Welfare Benefits National Benefit Services

What Is A Dependent Care Fsa Optum Financial

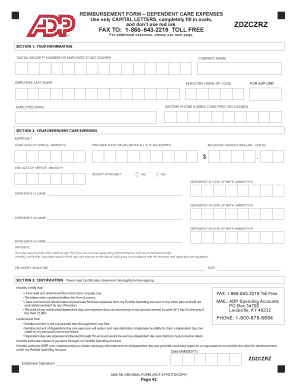

Dependent Care Fsa Claim Form Adp Flexible Spending Accounts Fill And Sign Printable Template Online

Health Flexible Spending Account Vs Dependent Care Flexible Spending Account

Core Section 129 Dependent Care Assistance Fsa Plan Document Brochure Core Documents

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Health Care And Dependent Care Fsas Infographic Optum Financial

Dependent Care Flexible Spending Account Save On Care Expenses

Dependent Care Fsa Mcclatchy Livewell

Everything You Need To Know About Dependent Care Fsas Youtube

What Is A Dependent Care Fsa Wex Inc

What Expenses Are Covered By My Dependent Care Fsa

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

What Is A Dependent Care Fsa Dcfsa Paychex

Can You Use A Flexible Spending Account Fsa For Preschool Intrepid Eagle Finance

Dependent Care Fsa Eligible Expenses Qualified Child Care Items